Retirement

In one generation ideas on how to boost retirement income have done a 180. Before the Boomers begin to retire, earning extra money in retirement was considered unnecessary. Furthermore it was thought of as an awkward and distressing concept. Now, almost everyone expects to supplement their retirement savings with active income.

The questions retirees are asking themselves are:

- How can I earn money after retirement?

- What are the best jobs for retirees?

- How can I become a millionaire after I retire?

- If I'm living paycheck to paycheck now, what happens after I retire?

- What am I going to do with all my free time?

- How am I going to stay relevant?

This blog will answer those questions and more. It's part of a Retirement Income series. The topics are:

- Creating Retirement Income

- How Much Do I Need to Retire?

- Jobs for Retirees

- Things to Do After Retirement

- How to Retire Early

- Generating Passive Income for Retirement

- Ideas to Boost Retirement Income (this blog)

The Opposite of Normal

The world witnessed a rapid, relentless disruption from the ordinary. Caused by a worldwide pandemic. A Coronavirus disease called COVID-19.

Bars and restaurants shuttered. Gyms and fitness facilities abandoned. Hairdressers, massage therapists, yoga instructors, bartenders, wait staff, and service employees of all kinds unemployed. Tens of millions internationally suddenly out of work. Travel at a complete halt. Retirement savings severely diminished. International stock markets lost record levels. Precious metals, like gold and silver, prices collapsed. Businesses large and small, on the brink of failure.

In addition, it was one of history's fastest and most brutal sell offs. While leaders tried hard to resolve the crisis, the turmoil persisted. In time the human spirit overcame the emergency as always with past catastrophes. By the time you read this article, COVID-19 will be a footnote in our past.

This was not the first major panic we have endured, and it will not be our last. The lesson learned is the dire necessity of having multiple streams of income from various sources.

Dig the well before you need the water.

The Best Source of Retirement Income

The disruption provided us with an abrupt education. We learned that we must protect our financial security. In addition to a primary source of income, something more is necessary. One thing became abundantly clear. Bolster personal finance, maintain cash flow and create extra cash. Think and do things differently from the past. We all need a robust work from home business.

What are the characteristics of the best source of retirement income?

- Home based

- Business ownership

- Leverages networks

- Generates monthly residual income

- System based for simplicity

- Low barrier to entry

- Ease of duplication

- Clear path to rapid income generation

- Based on high demand

- Strong ongoing support structure

- Technology driven

Another Stream of Income

Earning extra money is easy. The trick is finding something you enjoy doing. First, take a good look at yourself and determine what you're really looking for. Is it just more money or is it something else? As we age a natural inclination is to seek purpose and meaning in our lives. It becomes more essential to do something significant for humanity than merely making extra income.

Another way to look at earning money in retirement is the fun factor. In addition to supplementing your savings, bringing in more money can be an exciting and fulfilling adventure. Look at the following list and put a mental check mark next to any that you find appealing.

- Earn income by hosting international travelers by renting extra space on Airbnb.

- Interact with passengers as a Lyft or Uber driver.

- Make furry friends as a dog walker or pet sitter.

- Exercise your brain as a guest blogger.

- Engage your artistic nature by making things and selling them on Etsy.

- Create an online store with Amazon.

- Become a passive income entrepreneur with your own Network Marketing business.

Most noteworthy. Know this list is limited only by your imagination. Furthermore, it's important to note that the scale of potential income varies tremendously depending on what you are most drawn to. Especially relevant is the difference in earning potential between a vocation like dog walking and becoming a self-employed businessperson. As a result, becoming financially free when you retire depends on your choice of how to invest your time.

Two Ways to Boost Income After You Retire

There are really two ways to make money once you've retired. One way is to trade time (your finite hours or days) for money. This is active income. That's because it requires you to be actively doing something like dog walking or Uber driving to get a pay check.

There is another way. It is called beach money. This is passive income. The best way to understand it is to read the book by the same title by Jordan Adler. Amazon describes it as follows. Beach Money shows you how to compress a 30-year career into 3 to 5 years, design your life around your free time instead of around your work schedule, and turn your yearly income into a monthly income!

Become a Retired Millionaire

The Wealth Creation Mastermind advocates learning the secrets used by millionaires to become financially free. Do you want to earn a lot more? Do you know that you cannot depend on Social Security for financial freedom? Then we highly encourage you to become a member and participate in our free 9 month training where you will learn to think the right way about money, freedom and prosperity.

The Secret to Freedom

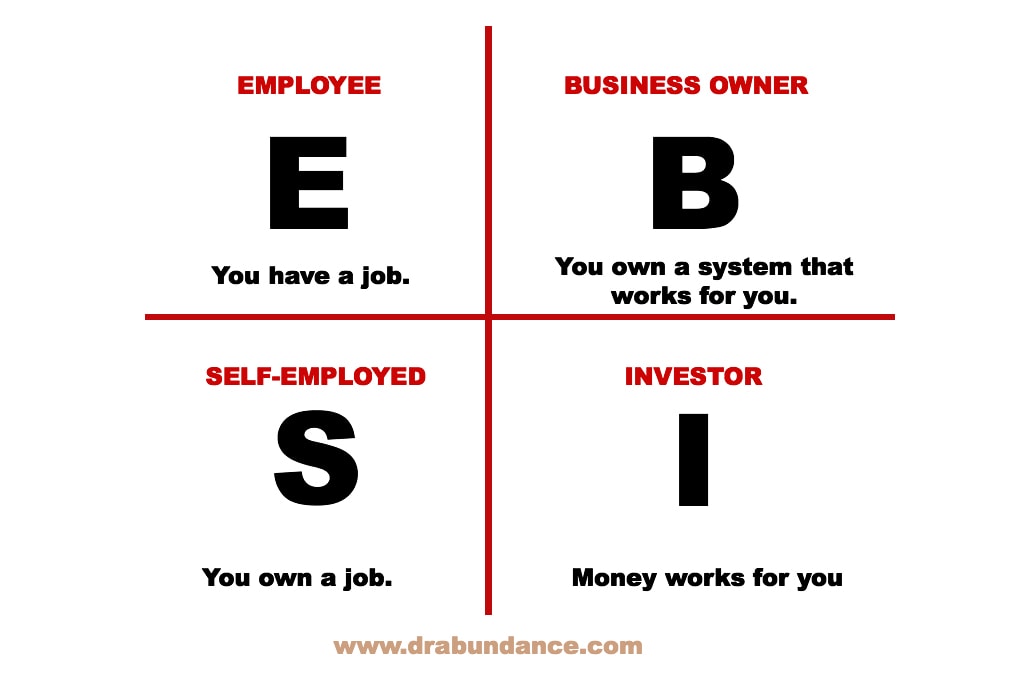

In his book Rich Dad, Poor Dad, Robert Kiyosaki describes the four ways people make money. They are E-S-B-I. Yes, it's possible to create extra cash with any of the four ways. The secret to freedom is found in two.

- Employee

- Self Employed

- Business Owner

- Investor

According to Kiyosaki, if you want to be rich, you need to be a business owner and an investor.

Employee

Virtually everyone you know is using this strategy to get a paycheck. You work for someone else in their business. This includes flipping burgers in a mom and pop corner diner all the way up to being an engineer for a massive technology company. You put in time. In exchange, you receive a paycheck. It's called a job. You work hard enough not to get fired, and you are paid enough not to quit. The acronym for job is:

- J-ust

- O-ver

- B-roke

You are building someone else's dream, not your own. In addition to being paid what the job description says you are worth, there is another downside. It's estimated by Forbes magazine that more than half of U. S. workers are unhappy in their jobs. In conclusion, it is clear that having a job is not the path to happiness, or financial freedom and security.

Self Employed

This is a broad and general category. The most basic way to know if you are self-employed or not has to do with how you pay income tax. The self-employed take advantage of the tax code in ways the employed cannot. Here are some examples.

- Independent Contractor - you are an independent businessperson

- Freelancer - Engaged by numerous other businesses

- Online business - including affiliate sales like Amazon or Shopify

- Franchise owner and operator - this includes things like fast food

- Dentists - many operate as sole proprietors or partnerships

The downfall for the self-employed? It often translates into owning your job. You may not have an employer you answer to but frequently there are so many restrictions it amounts to almost the same thing.

The three common obstacles preventing more wage earners from leaving their job and striking out on their own are:

- Health Insurance

- Retirement

- Accounting

Each of these can be easily managed. Responsible business planning is required. The best advice is to consult your tax advisor to determine the different options available. You may be amazed when you begin to discover the tax advantages open to the self-employed. This is a step in the right direction, but it usually doesn't bestow the blessing of financial independence.

There is a tremendous difference between being self-employed and owning a large business.

Business Owner

The distinction between being self-employed and owning a business may at first seem obscure. The difference is in the amount of freedom it affords. If your time is required to run the daily operations of your business, you have no real freedom. The business owns you. Consequently, it's the opposite of autonomy. The key is discovered in a story Kiyosaki tells about Thomas Edison in his book The Business School for People Who Like Helping People.

What made Edison rich and famous, contrary to popular belief, was not the light bulb! Sure, he improved upon it and made it commercially viable, but that wasn't the secret to his success. Edison understood the importance of building systems and networks. The thing that distinguished him from his rivals was his system for distributing electric power to his customers. It was the network of poles and wires that enabled him to share the electricity with the end user.

Another example of a network is the internet. Rather than electricity, the world wide web is a distribution system for information. Untold wealth and prosperity is built on the back of networks. Kiyosaki points out that the richest people in the world all build networks.

Networks

Facebook, Instagram, Twitter, and LinkedIn are all example of social networks. These were originally conceived as a way to stay in touch with friends, relatives and acquaintances. As they’ve evolved, more and more people use them as business tools to brand themselves. They use social networks to create followers, and get their unique message to like-minded recipients. To find and develop business connections with them. Furthermore, these networks allow business people to innovate, transform and revolutionize how they do business.

We now live in the network era. There are more networks in every business than most people ever think about. However, it is these networks that enable most businesses to prosper. Larry Hawes' Forbes article provides an excellent description of the Types of Business Networks. They include:

- Voice - personal and group communication

- Financial - the flow of money between individuals and institutions

- Supply - everything built is supplied from elsewhere

- Transportation - consider where anything you consume originated

- Retail - most business sell through multiple channel partners

- Service - think of what is available on the Cloud

- Content - data, information and knowledge are created and shared

- Social - relationships between individuals and groups

Consider the vast number of business opportunities generated within the above list. It stimulates the idea of creating your own network. You can leverage networks to produce ways to earn extra income.

Invester

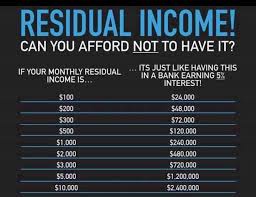

Money at work is an ideal way to create extra income.

As this chart illustrates, the benefit of money making more money is an intoxicating approach to prosperity as you age. Money at work is a great way to boost income both before you retire, and once you retire. It requires disciple, knowledge and a bit of good fortune to create it. The chart makes the comparison of receiving a monthly residual income on different amounts of money invested at a 5% annual rate of return. If you want to receive $10,000 per month it would require an investment of $2,400,000. Especially relevant, the real question that arises is this. How can you create residual income if you have no money to invest?

Become Free and Boost Retirement Income

The Wealth Creation Mastermind is a group of independent entrepreneurs. Most noteworthy, our conviction is that to transform your life, you must transform your mind. We add value to our members with a curriculum of study. In addition, the educational program empowers members with knowledge. The outcome is the psychology of abundance. Next, we present the option to participate in specific vehicles designed to solve enormous challenges facing humanity today.

First of all, the idea we are talking about is not a job. Furthermore, it is not based on how much retirement savings you've accumulated in your IRA or 401K account. Nor does it require years of sacrifice. No monthly investing over decades. It is the opposite of relying on the advice of a financial advisor. Moreover, it's fun, gratifying, challenging and mentally engaging. In conclusion, the result is autonomy, and the fulfillment of participating in a noble cause.

Open Minded or Closed?

Are you able to entertain an idea and evaluate it on its own merits? Due to the fact that most are influenced by the opinions of others, independent, deductive reasoning usually doesn't happen. Usually the majority of people allow others to think for them. While everyone has the capacity to make up their own mind, very few actually do. As a result, they make decisions based on the unseen pressure exerted by those in control of the masses.

If you want to revolutionize your results, you need a proven path to follow. This goes far beyond simple ideas on how to boost retirement income. Napoleon Hill, author of Think and Grow Rich, declared that thoughts are things. Members of the Wealth Creation Mastermind understand the truth of that statement. We engage in a 9-month curriculum of study in order to master our mental faculties. Every week you will attend two free online seminars. Consequently members learn to take control of their lives with the mind/money connection. The outcome is living the lifestyle of your desires. In closure, we highly recommend that you Become a Member of the WCM.

John Rogers is a former Wall Street portfolio manager and served as CEO of Premium Enterprises and President of The Colorado Tire Recycling Center. He transitioned to digital marketing, founding WealthCreationMastermind.com to empower home-based entrepreneurs with cutting-edge strategies. Creator of the “Mastering the Art of Wealth Creation” online course, John has driven significant growth in network marketing, achieving the Blue Diamond rank and earning the title of Univera Associate of the Year in 2015. His expertise in leveraging technology for financial success transforms how entrepreneurs achieve their business goals.